Zamówienie mebli z wniesieniem czy sprzętów elektrycznych i/lub elektronicznych oraz montaż urządzenia to powszechna kompleksowa usługa, którą w swojej ofercie posiada wiele przedsiębiorstw. Kiedy jednak przychodzi do rozliczeń podatku VAT […]

Przeczytaj w: 3 min

Włochy to atrakcyjny kierunek nie tylko pod kątem turystycznym, ale również pod kątem gospodarczym. Włoskie marki, szczególnie te z branży modowej i motoryzacyjnej są znane na całym świecie, a zagraniczni […]

Przeczytaj w: 5 min

Jeżeli sprzedajecie na Amazon w modelu FBA, mogliście spotkać się z pojęciem FBA Commingling. W szczególności niektóre transakcje w raporcie VAT Transaction report mogą posiadać oznaczenie tego typu. Z tego […]

Przeczytaj w: 3 min

Wielka Brytania to nie tylko najpopularniejszy kierunek imigracji zarobkowej Polaków, ale też największy europejski rynek e-commerce, co czyni go bardzo atrakcyjnym do ekspansji przez wielu przedsiębiorców. Zanim jednak rozpocznie się […]

Przeczytaj w: 5 min

W pierwszym tygodniu lutego Allegro ogłosiło, że do końca marca planuje udostępnić słowacką wersję swojej platformy – Allegro.sk. Jeżeli więc interesuje Cię ekspansja na ten rynek, możesz być zainteresowany tym, […]

Przeczytaj w: 5 min

Branża e-commerce to nieustannie rozwijający się sektor. Do tego mocno przyczyniła się pandemia, w trakcie której wiele rynków zanotowało rekordy wartości. Nie inaczej było z Czechami, które są obecnie na […]

Przeczytaj w: 5 min

Rozliczenia VAT w krajach Unii Europejskiej są kluczowym aspektem zarządzania finansami dla każdej firmy działającej na rynku międzynarodowym. Zrozumienie przepisów regulujących te rozliczenia jest niezbędne zarówno dla mieszkańców UE, jak […]

Przeczytaj w: 5 min

Branża e-commerce od lat nieustannie ewoluuje, a katalizatorem szczególnego przyspieszenia tego procesu stała się pandemia w 2020 roku. Nie inaczej jest z tym sektorem w Niemczech, czyli drugim (lub trzecim, […]

Przeczytaj w: 6 min

W dobie zmieniających się przepisów wpływających na prowadzenie działalności gospodarczej przedsiębiorcy muszą regularnie mierzyć się z nowymi wyzwaniami, m.in. w obszarze księgowości. Czasami jednak zdarzy się, że nie są oni […]

Przeczytaj w: 5 min

Przedsiębiorcy często szukają jak najbardziej optymalnych i opłacalnych rozwiązań dla swoich firm. W przypadku firm produkcyjnych powszechnym rozwiązaniem są przenosiny produkcji poza teren Unii Europejskiej. Wiąże się to nie tylko […]

Przeczytaj w: 5 min

Zapłata zobowiązań podatkowych to dla przedsiębiorców chleb powszedni. Niekiedy jednak proces ten okazuje się problematyczny, ponieważ nie do końca wiadomo, na jakie konto bankowe należy wpłacać należności związane z konkretnym […]

Przeczytaj w: 5 min

W obliczu rosnącej świadomości ekologicznej i zanieczyszczeń środowiska, władze Unii Europejskiej uchwaliły w 2019 roku tzw. dyrektywę SUP, której efektem są nowe obowiązki dla przedsiębiorców z państw członkowskich, mają na […]

Przeczytaj w: 5 min

Ochrona własności intelektualnej to bardzo istotny temat w branży e-commerce oraz cross-border e-commerce. Wielu sprzedawców niejednokrotnie spotkało się z ofertami zawierającymi podróbki oryginalnych, wytworzonych przez nich produktów. Ponadto, proceder ten […]

Przeczytaj w: 6 min

Branża e-commerce rozwija się z roku na rok, co potwierdzają rosnące liczby i wprowadzane nowe technologie oraz udogodnienia. Dotyczy to zarówno jakości usług świadczonych przez sprzedawców, jak i zadowolenia klientów. […]

Przeczytaj w: 6 min

Zastanawiasz się, jak odnieść sukces na Amazon? Kluczem jest zrozumienie i analiza Twojej sprzedaży. To nie tylko o liczenie zysków, ale o głębsze zrozumienie rynku i Twojego miejsca na nim. […]

Przeczytaj w: 5 min

Branża e-commerce z każdym rokiem przeżywa ewolucję. Firmy wdrażają coraz to nowsze rozwiązania, które pozwalają na optymalizację i automatyzację procesów, a w efekcie na wzrost sprzedaży. Na porządku dziennym jest […]

Przeczytaj w: 6 min

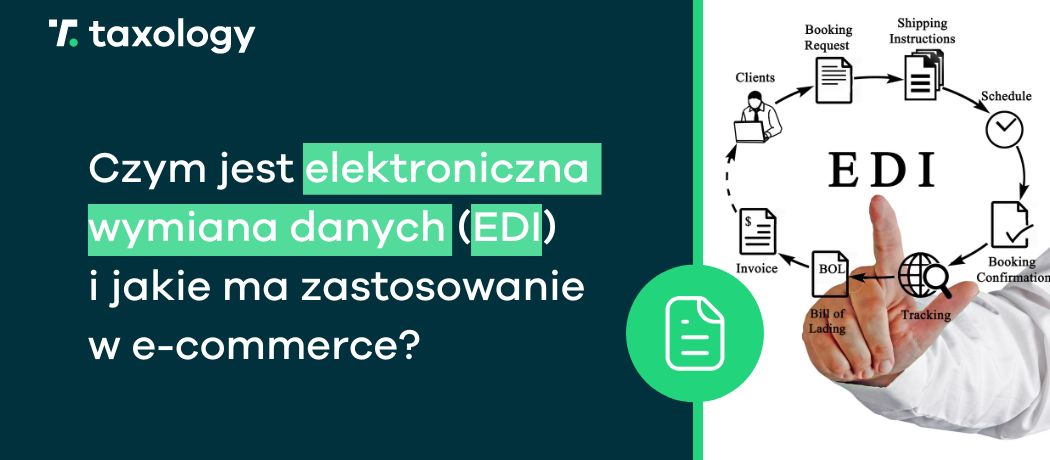

W dobie cyfryzacji automatyzacja jest jednym z czynników znacznie zwiększających wydajność przedsiębiorstwa, a można ją zastosować w bardzo wielu obszarach. Przykładem takiego jest wymiana informacji i przesyłanie dokumentów w całym […]

Przeczytaj w: 5 min

System self-publishing, czyli indywidualne wydawanie książek drukowanych, e-booków i innych treści pisanych oraz ilustrowanych, staje się w ostatnich latach coraz bardziej powszechny. W efekcie, na rynku pojawia się bardzo wiele […]

Przeczytaj w: 6 min

Nowy Rok to bardzo często czas nie tylko symbolicznego otwarcia nowego rozdziału, ale również faktycznych przemian. Tak jest również w przypadku 2024 roku, z początkiem którego w krajach Unii Europejskiej […]

Przeczytaj w: 5 min

Działalność gospodarcza może być prowadzona w różnych formach – np. jednoosobowa działalność, spółki osobowe lub spółki z o.o. Wybór formy prowadzenia działalności ma bezpośredni wpływ na sposób opodatkowania dochodów. Jednym […]

Przeczytaj w: 6 min

W branży e-commerce oczywistym jest, że klienci z większym prawdopodobieństwem sięgną po te produkty, które w ofertach zawierają recenzje innych konsumentów. W związku z tym, wielu zewnętrznych sprzedawców, którzy sprzedają […]

Przeczytaj w: 5 min

20 grudnia 1994 roku Parlament Europejski i Rada Europejska uchwaliły Dyrektywę 94/62/EC, która regulowała przepisy dotyczące odpadów i odpadów opakowaniowych. Ta jednak została znacząco zmieniona w 2018 roku przez Dyrektywę […]

Przeczytaj w: 6 min

Wielu przedsiębiorcom pojęcie Nowego Ładu kojarzy się z bardzo dużym zamieszaniem w zakresie rozliczeń podatkowych, ponieważ przepisu Nowego Ładu w bardzo krótkim czasie wprowadzały szereg istotnych zmian podatkowych. Przy głębszej […]

Przeczytaj w: 6 min

Kaufland Global Marketplace to platforma sprzedaży internetowej należąca do Schwarz Group jest jedną z największych platform marketplace w Europie. Można ją wręcz określić terminem multi marketplace, ponieważ oferuje możliwości sprzedaży […]

Przeczytaj w: 5 min

Podatek VAT to nieodłączny element branży e-commerce, jednak w tym artykule skupiliśmy się na innym, który także dotyczy przedsiębiorców, a chodzi o kasy fiskalne. Wiele firm, które zajmują się sprzedażą […]

Przeczytaj w: 6 min

Rumunia, kraj z ponad 19 milionami obywateli, dla wielu nie jest oczywistym kierunkiem ekspansji. Trzeba jednak zaznaczyć, że od wielu lat rynek ten przyciąga coraz więcej przedsiębiorców, a dlaczego tak […]

Przeczytaj w: 6 min

W listopadzie 2021 roku w mediach pojawiły się informacje o przejęciu czeskiej Grupy Mall oraz WE|DO przez polskie Allegro. Z kolei w maju bieżącego roku polski gigant zadebiutował na rynku […]

Przeczytaj w: 6 min

Element, który jest obecny w systemie gospodarczym w każdym kraju Unii Europejskiej to niewątpliwie podatek VAT. Czechy nie są tutaj wyjątkiem, jednak tak jak inne państwa członkowskie, posiadają własne przepisy […]

Przeczytaj w: 6 min

Wewnątrzwspólnotowa dostawa towarów to termin, na który można trafić bardzo często, szukając informacji o sprzedaży usług lub towarów, które są wysyłane np. z terytorium Polski na terytorium innego państwa członkowskiego […]

Przeczytaj w: 6 min

Podatek VAT to kluczowe źródło dochodu skarbu państwa w każdym kraju Unii Europejskiej, w związku z czym, unijne władze wprowadziły w 2021 roku narzędzie, które pozwala na jego łatwiejsze rozliczenia, […]

Przeczytaj w: 6 min

Biała lista podatników VAT to termin, z którym styczność miała zapewne większość przedsiębiorców. Jest on jednak szczególnie istotny w przypadku podatników zarejestrowanych jako czynni podatnicy VAT. W poniższym artykule przedstawiliśmy […]

Przeczytaj w: 6 min

Francuski rynek e-commerce jest jednym z najważniejszych w Europie i stale rośnie. W świecie handlu online Cdiscount to jedna z czołowych europejskich platform, która umożliwia sprzedawcom dostęp do francuskiego klienta, […]

Przeczytaj w: 11 min

Wraz z rosnącą świadomością o bezpieczeństwie żywności i żywienia suplementy diety zyskują na popularności. Powstają sklepy, w których można znaleźć dietetyczne środki spożywcze specjalnego przeznaczenia, które są produkowane pod nadzorem […]

Przeczytaj w: 5 min

Jeżeli sprzedajesz produkty, które klasyfikują się jako karma dla zwierząt, możesz korzystać z obniżonych stawek VAT dla sprzedaży na terytorium Polski. Zapewne, zastanawiasz się, czy możliwe jest stosowania preferencyjnych stawek […]

Przeczytaj w: 5 min

Już teraz wiadomo, że w 2024 roku nastąpi znacząca zmiana dotycząca fakturowania. Wystawianie faktur zostanie scentralizowanie i będzie następowało za pomocą tzw. Krajowego Systemu e Faktur (KSeF). Ponadto dotychczasowe faktury, […]

Przeczytaj w: 8 min

Sprzedajesz kawę do konsumentów z innych krajów Unii Europejskiej? Zapewne wiesz, że od kilku lat dostawa kawy jest objęta w Polsce stawką VAT 23%. Czy wiesz jednak, że w niektórych […]

Przeczytaj w: 4 min

W ostatnich latach wyraźnie widać wzrost świadomości ekologicznej, za którym idą także zmiany przepisów oraz tworzenie nowych narzędzi z tym związanych. W Polsce przykładem takiej sytuacji są regulacje, z których […]

Przeczytaj w: 10 min

Sprzedaż na platformach marketplace rośnie z roku na rok w ostatnich latach. Nic więc dziwnego, że wiele firm postanawia zacząć sprzedawać przy ich pomocy, dzięki czemu mogą one dotrzeć do […]

Przeczytaj w: 9 min

Platforma Kaufland należy do Grupy Schwarz (która jest m.in. właścicielem sieci sklepów Lidl) i jest to jeden z największych niemieckich marketplace’ów. Jak można przeczytać na oficjalnej stronie tej platformy, to […]

Przeczytaj w: 10 min

Fakturowanie — wystawianie faktur VAT, korekt, rachunków czy paragonów fiskalnych, generowanie jednolitych plików kontrolnych, ale też dbanie o faktury cykliczne czy faktury zaliczkowe — to jeden z najbardziej podstawowych elementów […]

Przeczytaj w: 6 min

Słowenia, podobnie jak inne państwa członkowskie Unii Europejskiej, posiada własne przepisy określające podatek VAT, który jest jednym z filarów gospodarki tego kraju. W tym państwie podatek ten oficjalnie figuruje pod […]

Przeczytaj w: 5 min

Dropshipping to coraz bardziej popularny model biznesowy, który pozwala przedsiębiorcom na sprzedaż produktów bez posiadania fizycznego magazynu. Dzięki niemu sklepy internetowe mogą oferować szeroką gamę produktów, nie inwestując w ich […]

Przeczytaj w: 7 min

W Rumunii podobnie jak w innych krajach członkowskich Unii Europejskiej, podatek VAT to kluczowy filar systemu gospodarczego. W związku z tym, przedsiębiorcy, którzy dokonują transakcji z kontrahentami prywatnymi z tego kraju, mogą […]

Przeczytaj w: 5 min

Będąc przedsiębiorcą, ważne jest akceptowanie i zrozumienie faktu, że zwroty są nieodłącznym elementem prowadzenia biznesu, szczególnie e-commerce. Jednak spójrzmy na to tak — to, co wydaje się wyzwaniem, może być […]

Przeczytaj w: 6 min

Podatek VAT, znany także jako podatek od wartości dodanej, to filar systemu gospodarczego każdego państwa Unii Europejskiej. Do tych zalicza się także Chorwacja, na której terenie, po spełnieniu pewnych warunków, […]

Przeczytaj w: 4 min

Podatek VAT, znany także jako podatek od wartości dodanej lub podatek od towarów i usług, to nieodłączny element funkcjonowania każdego kraju członkowskiego. Nie inaczej jest w przypadku Słowacji, która także […]

Przeczytaj w: 5 min

Podatek VAT, znany także jako podatek od wartości dodanej, nosi w Szwecji nazwę Mervärdesskatt. Podobnie jak innych krajach Unii Europejskiej, jest on nierozerwalną częścią systemu gospodarczego i w celu właściwego […]

Przeczytaj w: 6 min

Wielu przedsiębiorców, którzy planują ekspansję, często rozważa Belgię, jako potencjalny kierunek. Do tego często przyczynia się wysoki poziom rozwoju tego kraju. Co jednak istotne, wejście na nowy rynek wiąże się […]

Przeczytaj w: 6 min

Nie od dzisiaj wiadomo, że 4. kwartał to czas istnego szaleństwa zakupów, związanego z różnymi świętami, w tym zagranicznymi, które zdążyły także dotrzeć już do Europy, lub są na najlepszej […]

Przeczytaj w: 8 min

Podatek VAT jest jednym z najważniejszych składników systemu podatkowego każdego kraju członkowskiego Unii Europejskiej, stanowiąc ważne źródło dochodów dla budżetu państwa. Jednak jego funkcjonowanie i stawki mogą się różnić w […]

Przeczytaj w: 5 min

Kwestie związane z VAT to fundamentalne aspekty systemów gospodarczych krajów UE. Nie inaczej jest w Królestwie Niderlandów, gdzie podatek VAT znany jest także jako podatek BTW, a do właściwego prowadzenia […]

Przeczytaj w: 5 min

Branża e-commerce, a co za tym idzie rynek, rosną nieustannie. W efekcie, konsumenci mogą wybierać spośród coraz to nowszych produktów. Wśród nich niekiedy pojawiają się egzemplarze lub marki, które zdecydowanie […]

Przeczytaj w: 7 min

E-commerce rozwija się nieustannie, a mieszkańcy krajów UE coraz częściej kupują towary z Chin czy Stanów Zjednoczonych. Przy takich transakcjach trzeba jednak rozliczyć VAT, co niekiedy może być problematyczne. Naprzeciw […]

Przeczytaj w: 8 min

Na początku czerwca, prezydent Andrzej Duda zatwierdził podpisem pakiet uproszczeń SLIM VAT 3, który jest kolejnym krokiem w kierunku nowelizacji ustawy o podatku od towarów i usług, zwanej potocznie ustawy […]

Przeczytaj w: 8 min

Kiedy następuje międzynarodowa dostawa towarów i usług w krajach członkowskich Unii Europejskiej, podatek VAT to kwestia, które nie można pominąć. W takich transakcjach należy przeanalizować kategorie ww. dóbr podlegających opodatkowaniu, […]

Przeczytaj w: 5 min

Malta, jako kraj członkowski Unii Europejskiej, opiera swoje przepisy dotyczące podatku VAT na unijnych dyrektywach. Trzeba mieć jednak na uwadze, że nie oznacza to, że są one takie same jak […]

Przeczytaj w: 4 min

Podatek od wartości dodanej (VAT) jest kluczowym elementem systemu podatkowego w Unii Europejskiej, a zrozumienie jego zasad, stawek i wymagań w każdym kraju członkowskim to podstawa dla prowadzenia efektywnej działalności […]

Przeczytaj w: 5 min

Rozumienie zasad i regulacji dotyczących VAT w różnych krajach jest kluczowe dla prowadzenia skutecznego biznesu na międzynarodowym rynku. We Włoszech, podobnie jak w innych krajach Unii Europejskiej, obowiązują specyficzne zasady […]

Przeczytaj w: 5 min

Podatek VAT w Hiszpanii, podobnie jak w każdym kraju Unii Europejskiej, to nieunikniony aspekt dla wszystkich, którzy prowadzą działalność gospodarczą na terenie tego kraju lub prowadzą sprzedaż towarów i świadczą […]

Przeczytaj w: 5 min

Wielka Brytania to kierunek, który obiera wielu szukających pracy, a także wiele zagranicznych firm, które poszukują nowych rynków zbytu dla swoich towarów i usług. Trzeba jednak pamiętać, że w tym […]

Przeczytaj w: 4 min

Podatki to element systemu gospodarczego każdego kraju świata, w tym krajów członkowskich UE, do których zalicza się również Litwa. Z kolei jednym z najpopularniejszych, jeżeli nie najpopularniejszym, jest podatek VAT, […]

Przeczytaj w: 7 min

Zrozumienie i dostosowanie się do zagranicznych procedur podatkowych jest kluczowe dla każdego, kto świadczy usługi i sprzedaje towary objęte podatkiem VAT. Szczególnie ważne staje się to, gdy rozważamy ekspansję na […]

Przeczytaj w: 4 min

Rejestracja VAT w Niemczech to istotny krok dla każdej firmy prowadzącej sprzedaż na terenie tego kraju. Niemcy, jako jedna z największych gospodarek w Unii Europejskiej, zasługują na szczególną uwagę ze […]

Przeczytaj w: 4 min

Wyposażenie swojego przedsiębiorstwa w niezbędną wiedzę na temat podatku VAT, deklaracji VAT czy rozliczeń VAT, jest fundamentalnym elementem prowadzenia skutecznego biznesu międzynarodowego. Jest to szczególnie istotne, gdy rozważamy rynek austriacki, […]

Przeczytaj w: 4 min

Podatek VAT, znany także jako podatek od towarów i usług lub podatek od wartości dodanej, to bardzo złożony temat. Różni się on na poziomach krajowych, gdzie każde państwo może posiadać […]

Przeczytaj w: 5 min

W dobie dynamicznych zmian w prawie podatkowym, wprowadzanych w celu walki z oszustwami, pojawiają się nowe mechanizmy, które wymagają od przedsiębiorców zarówno zrozumienia, jak i właściwego wdrożenia. Jeden z nich, […]

Przeczytaj w: 8 min

Jak zarejestrować się jako podatnik VAT w Polsce? Proces ten może wydawać się skomplikowany, ale jest to fundamentalny krok dla większości przedsiębiorców chcących prowadzić swoją działalność gospodarczą. Podatek VAT, czyli […]

Przeczytaj w: 9 min

Sprzedaż wysyłkowa to bardzo szeroki temat, który łączy w sobie wiele różnych dziedzin – sprzedaży, negocjacji, IT czy logistyki. W tej ostatniej zawarte są kwestie transportowe, które mogą być dla […]

Przeczytaj w: 10 min

W świecie szybko rozwijającego się handlu elektronicznego, istotne jest zrozumienie terminologii, która towarzyszy tej dynamicznej branży. Słownik pojęć E-commerce to zasób dla wszystkich, którzy chcą wnikliwie zrozumieć ten ciągle ewoluujący […]

Przeczytaj w: 8 min

Podatki to nieodłączny gospodarki każdego państwa, a jednym z jego elementów jest podatek VAT, w Finlandii znany jest jako Arvonlisävero. Podlega on pod wytyczne Unii Europejskiej, w związku z czym […]

Przeczytaj w: 5 min

Podatek VAT, znany w Polsce jako podatek od towarów i usług lub podatek od wartości dodanej, dotyczy każdego kraju Unii Europejskiej. Nie inaczej jest z Cyprem, który ma w Europie […]

Przeczytaj w: 5 min

Podatek od wartości dodanej, powszechnie znany jako VAT, jest nieodłącznym elementem obrotu gospodarczego na świecie. Przepisy te często bywają skomplikowane i różnią się od siebie w zależności od kraju, jednak, […]

Przeczytaj w: 6 min

Podatek VAT jest powszechnie znany jako podatek od wartości dodanej z racji angielskiego sformułowania „Value Added Tax”. Natomiast w Polsce jego oficjalna nazwa to podatek od towarów i usług. Warto […]

Przeczytaj w: 7 min

Podatek VAT jest powszechnie znany jako podatek od wartości dodanej, a termin ten ma swoją genezę w języku angielskim, w którym skrót VAT oznacza „Value Added Tax”. Z kolei w […]

Przeczytaj w: 6 min

Optymalizacja procesów jest kluczowym elementem prowadzenia przedsiębiorstwa. Często zależy od specyfiki branży, jednak w logistyce, transporcie czy e-commerce, jest to szczególnie istotny aspekt, ponieważ wpływa na czas dostawy towarów do […]

Przeczytaj w: 5 min

Podatek VAT jest znany na świecie pod różnymi nazwami. Najbardziej powszechną jest podatek od wartości dodanej. Inni nazywają go podatkiem od konsumpcji, a w Polsce znany jest jako podatek od […]

Przeczytaj w: 6 min

Podatek VAT, czyli podatek od wartości dodanej towarów i usług, to nierozerwalny element systemów podatkowych w krajach Europy. W Grecji jest on jednym z najwyższych w Europie. Stawka podstawowa wynosi […]

Przeczytaj w: 5 min

Podatek VAT to podatek pośredni od wartości dodanej produktów i usług. Podobnie jak w innych krajach Unii Europejskiej, jest on obecny również w Luksemburgu. Obecnie, do końca 2023 roku, podatek […]

Przeczytaj w: 6 min

Dla wielu firm e-commerce na pewnym etapie, krokiem koniecznym do właściwego skalowania jest wyjście na nowe rynki w celu dotarcia do nowego grona klientów. W związku z tym, ci przedsiębiorcy […]

Przeczytaj w: 5 min

Przesunięcie magazynowe to inne określenie na tzw. dokument MM (Material Movement) lub przesunięcie międzymagazynowe, które służą do prowadzenia ewidencji magazynowej przemieszczanych towarów w obrębie jednej firmy. Jako przesunięcia magazynowe określa […]

Przeczytaj w: 6 min

W dzisiejszych czasach wiele firm prowadzi swoją działalność na terenie Unii Europejskiej, co wymaga od nich posiadania wewnątrzwspólnotowego numeru VAT. Ten numer jest niezbędny do poprawnego rozliczenia podatku VAT w […]

Przeczytaj w: 4 min

SAF-T to międzynarodowy format służący do raportowania transakcji dotyczących wymiany towarów i usług. Posiada on w Polsce swój odpowiednik, którym jest JPK, czyli Jednolity Plik Kontrolny. Jak to się jednak […]

Przeczytaj w: 4 min

Intrastat to europejski system statystyczny, który służy UE do zbierania informacji na temat wewnątrzwspólnotowego obrotu towarów. Funkcjonuje on od 1993 roku, a w Polsce został wdrożony wraz z jej przystąpieniem […]

Przeczytaj w: 6 min

Od 1 maja polski świat e-commerce ulegnie zmianie. W życie wejdzie unijna Dyrektywa DAC7, która dotyczy wszystkich państw członkowskich. Czy jednak będzie to diametralna zmiana? To pokaże czas, ponieważ jeszcze […]

Przeczytaj w: 8 min

VAT, czyli pośredni podatek od wartości dodanej dotyczy towarów i usług. W krajach Unii Europejskiej jest on obowiązkowy, a minimalna, podstawowa stawka VAT została ustalona na 15%. Każdy kraj może […]

Przeczytaj w: 6 min

Zrównoważony rozwój to już nie tylko hasło samo w sobie, lecz coraz większy nacisk i wymagania w różnych obszarach życia i biznesu. Jeśli więc rozpoczynasz ekspansję zagraniczną w Niemczech, jesteś […]

Przeczytaj w: 5 min

Podatek VAT, czyli podatek od wartości dodanej towarów i usług jest nieodłącznym elementem gospodarki większości krajów UE. Tak samo jest w przypadku Węgrzech. Jednak warto zaznaczyć, że w aspekcie podatku […]

Przeczytaj w: 5 min

Multichannel i omnichannel to terminy, które pojawiają się niemal za każdym razem, gdy temat dotyczy skalowania sprzedaży w e-commerce. Pierwszy dotyczy sprzedaży lub komunikacji za pośrednictwem różnych kanałów. Drugi dotyczy […]

Przeczytaj w: 5 min

Wiele firm sprzedających towary i świadczących usługi w pewnym momencie swojej działalności postanawia wyjść poza granice rodzimego kraju. W związku z tym postanawiają dokonać ekspansji na rynki zagraniczne, a nieodłącznym […]

Przeczytaj w: 4 min

Podatek VAT to podatek od wartości dodanej. Należy on do grupy podatków pośrednich, co oznacza, że jest wliczony w cenę towarów i usług, których opłacenie leży w gestii konsumenta końcowego. […]

Przeczytaj w: 5 min

Ekspansja zagraniczna to niewątpliwie jeden z najbardziej perspektywicznych kierunków dla przedsiębiorców chcących skalować swój biznes. Szczególnie dotyczy to sytuacji, gdy na rodzimym rynku osiągnięte zostało już niemal wszystko, a możliwości […]

Przeczytaj w: 9 min

Podatek VAT jest powszechny w Europie i ma kluczowe znaczenie dla budżetów państwowych. W Belgii, jest on jednym z najważniejszych źródeł dochodów dla państwa. W tym artykule omówimy szczegóły VAT-u […]

Przeczytaj w: 8 min

VAT, czyli podatek od wartości dodanej, jest jednym z podstawowych podatków obowiązujących w Unii Europejskiej. W Bułgarii podatek ten regulowany jest przez ustawę o podatku od wartości dodanej. W tym […]

Przeczytaj w: 5 min

System płatności online to nieodłączny element e-commerce w dzisiejszych czasach. Oprócz samego transferu pieniędzy na konto sklepu internetowego i sprzedawcy, każdy system zapewnia także różne formy płatności, szybkość realizacji czy […]

Przeczytaj w: 7 min

Amazon to największa platforma e-commerce z milionami użytkowników na całym świecie – zarówno kupców, jak i sprzedających. W związku z tym, w celu nadążenia za rosnącymi wymaganiami dotyczącymi drugiej z […]

Przeczytaj w: 6 min

W celu właściwego skalowania swojego biznesu, wiele firm w pewnym momencie stawia na rozszerzenie działalności, co może oznaczać wyjście na rynki zagraniczne. Po zakończeniu tego procesu wiele firm niewątpliwie cieszy […]

Przeczytaj w: 5 min

Magazyn konsygnacyjny, często określany także jako skład konsygnacyjny, to rodzaj magazynu, w którym przedmioty są przechowywane i sprzedawane na zasadzie konsygnacji, czyli umowy między sprzedawcą (konsygnantem), a właścicielem magazynu (konsygnatariuszem), […]

Przeczytaj w: 4 min

Podatek VAT (value-added tax), czyli podatek od wartości dodanej towarów i usług to nieodłączny element prowadzenia biznesów związanych z sektorem e-commerce, w szczególności sytuacji kiedy posiada się własny sklep internetowy. […]

Przeczytaj w: 4 min

Podatek VAT (value-added tax), czyli podatek od towarów i usług, obowiązuje w Słowenii w trzech stawkach. Poza główną stawką 22%, niektóre produkty i usługi objęte są stawkami zredukowanymi w wysokości […]

Przeczytaj w: 5 min

Zapanowanie nad procesami logistycznymi to wyzwanie w e-commerce, które staje się coraz trudniejsze wraz z rozwojem firmy, a szczególnie, gdy na horyzoncie pojawiają się plany ekspansji zagranicznej. Usługa e-commerce fulfillment […]

Przeczytaj w: 8 min

Podatek VAT, czyli podatek wartości dodanej towarów i usług, podzielony jest w Irlandii na wyjątkowo dużą liczbę stawkę podstawową, trzy stawki obniżone oraz stawkę zerową. Obecnie, podstawową stawką VAT w […]

Przeczytaj w: 5 min

Rola dużych platform marketplace w globalnym e-commerce nieprzerwanie wzrasta i nie inaczej jest na rynkach europejskich. Niezależnie od kraju to właśnie tego typu witryny w dużym stopniu zajmują wysokie miejsca […]

Przeczytaj w: 9 min

Sektor E-commerce nieustannie się rozwija, co było szczególnie widocznie w ostatnich dwóch latach. Wraz z jego rozwojem, przedsiębiorstwa poszerzały swoje oferty i grupy docelowe, którymi, nierzadko, byli konsumenci z innych […]

Przeczytaj w: 5 min

Call-off Stock na Amazon to coraz popularniejsza usługa, która ułatwia vendorom proces sprzedaży na rynkach zagranicznych. W tym artykule opiszemy dokładnie, na czym polega call-off stock i kto może z […]

Przeczytaj w: 5 min

Prowadzenie firmy e-commerce wymaga stałego trzymania ręki na pulsie i kompleksowego podejścia. Stabilny rozwój zależy od szerokiej liczby czynników – od sprzedaży online i SEO po logistykę i obsługę klienta. […]

Przeczytaj w: 8 min

Podatek VAT (value-added tax), czyli podatek od wartości dodanej, został wprowadzony na terenie Chorwacji w 1998 roku. Poza główną stawką 25%, niektóre produkty i usługi objęte są stawkami zredukowanymi w […]

Przeczytaj w: 3 min

Pędzący rozwój branży e-commerce sprawia, że mamy na rynku coraz więcej wyspecjalizowanych agencji, które oferują usługi dedykowane właśnie dla firm sprzedających w internecie. Zobacz, jakie istnieją firmy wspierające e-commerce i […]

Przeczytaj w: 8 min

Podatek VAT (value-added tax), czyli współczesny podatek obrotowy od towarów i usług, został wprowadzony w Holandii w 1969 roku i wynosił 12%. Co więcej, podatek VAT w Holandii określa się […]

Przeczytaj w: 7 min

Wybór platformy e-commerce dla sklepu internetowego z każdym rokiem wydaje się coraz trudniejszy. Konkurencyjne rozwiązania prześcigają się na wielu płaszczyznach, od łatwości obsługi i optymalizacji po błyskawiczne integracje z wieloma […]

Przeczytaj w: 11 min

Podatek VAT (value-added tax) od sprzedaży towarów i usług został wprowadzony w Słowacji w 1993 roku. Na dzień dzisiejszy, główna stawka VAT w Słowacji wynosi 20%, a niektóre produkty i […]

Przeczytaj w: 4 min

Podatek VAT (value-added tax), czyli podatek od towarów i usług, został wprowadzony w Rumunii w 1993 roku. Poza główną stawką 19%, niektóre produkty i usługi objęte są stawkami zredukowanymi w […]

Przeczytaj w: 3 min

Jedną z kluczowych kwestii, jakie wyróżniają Amazon pośród konkurencyjnych marketplace’ów, jest model sprzedaży FBA, czyli Fulfillment by Amazon. Polega on na tym, że sprzedawcy zamiast wysyłać produkty samodzielnie do klientów, […]

Przeczytaj w: 6 min

Podatek VAT Czechy (value-added tax), czyli podatek od wartości dodanej towarów i usług, obowiązuje w czterech wariantach. Poza podstawową stawką 21%, istnieją dwie obniżone stawki, czyli 15% oraz 10%, a […]

Przeczytaj w: 5 min

Platformy marketplace nie przestają rosnąć w siłę i coraz więcej sprzedawców to właśnie tym kanałom poświęca najwięcej uwagi. Pytanie tylko, czy w przypadku każdego biznesu e-commerce to na pewno dobry […]

Przeczytaj w: 6 min

Jednym z kryteriów, które są kluczowe w odniesieniu sukcesu na Amazon, jest błyskawiczny i niezawodny proces wysyłki oraz ewentualnych zwrotów produktów. Aby to osiągnąć, większość sprzedawców wybiera jedną z dwóch […]

Przeczytaj w: 3 min

Największy marketplace na świecie wywołał w ostatnich latach e-commerce’ową gorączkę złota. Z roku na rok Amazon otwiera platformy na kolejnych rynkach, a sprzedawcy z rozmaitych krajów i branż zostają vendorami, […]

Przeczytaj w: 4 min

Strategie wejścia lub podbicia zagranicznych rynków są różne: od eksportu, przez otwarcie filii, po fuzję przedsiębiorstw. Ekspansji często towarzyszą kwestie finansowe, prawne i… społeczne. Dlatego właśnie, bez względu na przyjętą […]

Przeczytaj w: 3 min

Amazon znany jest z bardzo restrykcyjnych zasad dotyczących sprzedawców. Dowiedz się jaka jest pełna lista produktów zakazanych przez Amazon, zanim Amazon zablokuje Twoje konto. Poniżej znajdziecie wszystkie kategorie produktów, wobec których […]

Przeczytaj w: 6 min

Ze względu na szereg czynników, a głównie pandemię, rozwój branży e-commerce w ostatnich latach przybrał bardzo szybkie tempo. Ze względu na konieczność przetrwania i rosnącą konkurencję, sprzedaż w internecie zaczęły […]

Przeczytaj w: 4 min

Poszerzanie działań e-commerce na kolejne kraje niesie za sobą szereg wyzwań. Wiele z nich, jak np. tłumaczenie ofert czy proces wysyłki, można bez większych przeszkód powielać na każdy kolejnych rynek. […]

Przeczytaj w: 6 min

ASIN (Amazon Standard Identification Number) to wewnętrzny numer numer nadawany automatycznie przez Amazon podczas tworzenia listingu produktów. Można go znaleźć w adresie URL produktu oraz w informacjach dodatkowych na stronie […]

Przeczytaj w: 4 min

Olbrzymia liczba kategorii produktów i pędzący rozwój Amazona na kolejnych rynkach pokazuje, jak duże możliwości platforma daje sprzedawcom w wielu branżach. Na amerykańskim marketplace sprzedają zarówno rzemieślniczy producenci żywności, jak […]

Przeczytaj w: 6 min

W dobie olbrzymiej konkurencyjności w branży e-commerce dywersyfikacja sprzedaży to jeden z podstawowych kroków nie tylko w celu rozwoju firmy, ale również w zwiększeniu jej zysków. Dlatego warto wykorzystać potencjał […]

Przeczytaj w: 7 min

Przedsiębiorcy prowadzący sklepy internetowe w Polsce coraz częściej decydują się na otwarcie sprzedaży zagranicznej i to nie tylko do najbliższych nam geograficznie krajów, ale również na rynki położone dalej.

Przeczytaj w: 3 minOd powstania Taxology w roku 2019 wiele się zmieniło. Wyspecjalizowaliśmy się w nowych obszarach i znacznie poszerzyliśmy naszą ofertę. Zaczęliśmy świadczyć usługi VAT Compliance w większości europejskich krajów i stworzyliśmy […]

Przeczytaj w: 3 min

Jak nazywa się numer VAT po niemiecku? Jak wygląda NIP niemieckiej firmy i gdzie znaleźć NIP niemieckiej firmy? Jak nazywa się niemiecki urząd skarbowy? Jeżeli zastanawiasz się, czy do sprzedaży […]

Przeczytaj w: 5 min

Po Brexicie przedsiębiorcy mniej chętnie podejmują się sprzedaży wysyłkowej z Polski do klientów z Wielkiej Brytanii. Wynika to z niepewności związanych z nowymi formalnościami.

Przeczytaj w: 5 min

Wchodząc na Amazon, zyskujesz dostęp do międzynarodowego rynku, a co za tym idzie okazję do dużego zarobku. Platforma często wychodzi naprzeciw swoim klientom i oferuję m.in. różne modele współpracy. Jednym […]

Przeczytaj w: 8 min

Planując zakup lub sprzedaż towarów do krajów poza Unią Europejską musisz pamiętać o niezbędnych formalnościach. Jedną z nich jest uzyskanie numeru EORI, który jest niezbędny do wszystkich transakcji i czynności […]

Przeczytaj w: 5 min

Jeśli prowadzisz e-commerce, z pewnością doskonale wiesz, że utrzymanie poziomu zapasów na odpowiednim, bezpiecznym poziomie bywa wymagającym zajęciem. Zarówno sytuacje, w których mierzysz się z brakiem towaru, jak i te, […]

Przeczytaj w: 5 min

Zbliża się sezon letni i przychodzi czas na zakup nowego sprzętu sportowego. Zabierasz się za złożenie na Amazonie zamówienia na kilka nowych ciuchów i akcesoriów. Nie jest tego dużo, jednak zależy […]

Przeczytaj w: 5 min

Może nie wszyscy o tym wiedzą, ale platforma Zalando ma również ma swój program partnerski – Connected Retail, który umożliwia sprzedawanie produktów na tej platformie. Jak zacząć tam sprzedawać i […]

Przeczytaj w: 4 min

Jak przygotować się do sprzedaży online w Niemczech? Tutaj znajdziesz kompletne informacje na temat modeli sprzedaży na Amazon i kwestii podatkowych.

Przeczytaj w: 5 min

Bazując na wynikach sprzedaży oszacowaliśmy, że zapotrzebowanie na nasz produkt powinno wzrosnąć o około 15% względem poprzedniego roku. W związku z tym planujemy produkcję, zamawiamy wymagane części i w dalszej […]

Przeczytaj w: 6 min

Pomimo globalizacji współczesnego świata również w obszarze handlu, wciąż każdy z lokalnych rynków e-commerce ma własną specyfikę. Co zrobić, by skutecznie podbić rynek krajów sąsiadujących?

Przeczytaj w: 5 min

Chcesz sprzedawać za granicą i zastanawiasz się nad kwestiami podatkowymi? Z tego artykułu dowiesz się, kiedy masz obowiązek rejestracji do VAT za granicą i na czym ona właściwie polega.

Przeczytaj w: 6 min

Przedsiębiorca, który myśli o skalowaniu firmy może zdecydować się na wejście z produktem na zagraniczne rynki. Jest to przełomowy moment dla biznesu. Jednak, w związku z nim, czekają go dodatkowe […]

Przeczytaj w: 4 min

Jak agregować dane w sprzedaży wielokanałowej? Dlaczego zrozumienie i analiza danych w e-commerce jest tak ważna? Przeczytaj by dowiedzieć się więcej.

Przeczytaj w: 3 min

Jak zacząć sprzedawać na Amazon zgodnie z zasadami VAT w UE? Czy usługi VAT na Amazonie to jedyne rozwiązanie? Jaki jest koszt? W tym artykule dowiesz się o usługach VAT […]

Przeczytaj w: 5 min

Prowadzisz działalność e-commerce, a odbiorcami Twoich towarów są klienci z Unii Europejskiej? Rozliczenia podatku VAT spędzają Ci sen z powiek? Weź głęboki oddech i przekonaj się, co zyskasz na współpracy […]

Przeczytaj w: 5 min

Jeśli już prowadzisz biznes e-commerce to z pewnością już zetknąłeś się z pojęciem „fulfillment”, ale jeśli dopiero zaczynasz to powinieneś wiedzieć o co w tym chodzi. Fulfillment to po prostu […]

Przeczytaj w: 6 min

WSTO, czyli wewnątrzwspólnotowa sprzedaż towarów na odległość to po prostu sprzedaż wysyłkowa towarów dla klientów prywatnych z krajów Unii Europejskiej.

Przeczytaj w: 8 min

Prowadzisz sprzedaż wysyłkową za granicę za pośrednictwem portali Amazon lub eBay? Masz dość nieustannych zmian w przepisach dotyczących kwestii podatkowych? Chcesz mieć pewność, że poprawnie rozliczasz się z VAT-u? Sprawdź […]

Przeczytaj w: 5 min

Od 1 lipca 2021 roku obowiązuje procedura VAT-OSS (One-Stop-Shop), która ma ułatwić sprzedaż wysyłkową towarów między krajami Unii Europejskiej. Czy rzeczywiście dzięki temu zniknie obowiązek rejestracji na VAT w innych […]

Przeczytaj w: 10 min

BREXIT spowodował wiele wątpliwości odnośnie rozliczenia VAT sprzedaży realizowanej na rzecz kontrahentów z Wielkiej Brytanii. W zależności od wartości transakcji, kanału sprzedaży oraz statusu odbiorcy sposób rozliczenia VAT może wyglądać […]

Przeczytaj w: 6 min

Już 1 lipca 2021 roku zacznie obowiązywać procedura VAT-OSS, która ma ułatwić sprzedaż wysyłkową towarów między krajami Unii Europejskiej. Czy rzeczywiście dzięki temu zniknie obowiązek rejestracji na VAT w innych […]

Przeczytaj w: 5 min

Sprzedając produkty online musimy je w jakiś sposób identyfikować. Jeśli nasz produkt ma różne warianty kolorystyczne, rozmiarowe lub sprzedajemy je w różnych wersjach językowych to sama nazwa przestaje być wystarczająca. […]

Przeczytaj w: 5 min

1 stycznia 2021 r. Wielka Brytania opuściła jednolity rynek UE i unię celną oraz wszystkie polityki UE. W rezultacie utraciła wszystkie prawa i korzyści, jakie miała jako państwo członkowskie UE […]

Przeczytaj w: 3 min

W ostatnich latach rynek e-commerce rośnie bardzo dynamicznie, co można obserwować między innymi na przykładzie wzrostów platformy Amazon. W sprzedaży online nie należy jednak zapominać o kwestiach podatkowych, związanych głównie […]

Przeczytaj w: 4 min

Od 1 stycznia 2021 Wielka Brytania nie będzie dłużej uznawana za terytorium Unii Europejskiej na potrzeby rozliczeń VAT. W konsekwencji, zmianie ulegną zasady opodatkowania i dokumentowania dostaw towarów transportowanych z […]

Przeczytaj w: 5 min

Naturalnym wyborem dla sprzedawców, którzy planują rozwijać sprzedaż na Amazon jest usługa Fulfillment by Amazon (FBA). Pozwala to na magazynowanie towarów w magazynach Amazon oraz na oddanie im całego procesu […]

Przeczytaj w: 7 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, czyli od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to podatek […]

Przeczytaj w: 8 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, inaczej mówiąc od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to […]

Przeczytaj w: 6 min

Kupujesz lub zamierzasz kupować towary z krajów spoza Unii Europejskiej? A może masz kontrahentów, którzy chcieliby kupić Twoje produkty i również są z krajów spoza UE? Zanim zaczniesz wykonywać takie […]

Przeczytaj w: 6 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, czyli od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to podatek […]

Przeczytaj w: 6 min

Zwykła wymiana handlowa w Unii Europejskiej nie różni się zbytnio od normalnych, krajowych transakcji, ponieważ nie ma obciążeń celnych i dodatkowych obowiązków. Może się jednak zdarzyć, że jeśli przekroczymy pewne […]

Przeczytaj w: 3 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, czyli od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to podatek […]

Przeczytaj w: 6 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, inaczej mówiąc od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to […]

Przeczytaj w: 7 min

Podatek VAT w Niemczech określa się zarówno jako: Mehrwertsteuer i Umsatzsteuer. Mehrwertsteuer po polsku to podatek od wartości dodanej, a Umsatzsteuer to podatek od sprzedaży. Dowiedz się, jaka jest podstawowa […]

Przeczytaj w: 5 min

VAT (value-added tax), czyli podatek od towarów i usług (PTU) to podatek od wartości dodanej, czyli od przyrostu wartości dóbr w wyniku procesu produkcji lub tworzenia usług. VAT to podatek […]

Przeczytaj w: 6 min

Magazyny Amazon w Europie znajdują się w 7 krajach. Mocno ułatwia to pracę sprzedawców, którzy skorzystali z metody Amazon FBA, zamiast Amazon FBM. Ma to też wpływ na szybkość z […]

Przeczytaj w: 5 min

Co to jest VAT-OSS (One-Stop-Shop), który zostanie wprowadzony w 2021 roku w UE? Kto będzie mógł skorzystać z rozliczeń przez system VAT-OSS? Jak przygotować się do VAT-OSS? VAT-OSS a sprzedaż FBA […]

Przeczytaj w: 5 min

Jakie zmiany sprzedawców na Amazon niesie ze sobą Brexit, czyli wyjście Wielkiej Brytanii z Unii Europejskiej? Jak będzie wyglądać sprzedaż w modelu EFN i PAN-EU po Brexit? Jak duże to […]

Przeczytaj w: 5 min

Jak sprzedawać na Amazon? Czy warto sprzedawać na Amazon? Jak zarejestrować nowe konto sprzedawcy, jaki rodzaj konta wybrać, jak dodawać produkty, co to jest listing, jak wysyłać dany produkt do klientów, […]

Przeczytaj w: 13 min

Korzyści płynące ze sprzedaży towarów na platformie Amazon wydają się oczywiste, a dynamiczny rozwój firmy, która decyduje się na współpracę z tym światowym gigantem, jest najważniejszą z nich. Udostępniając swoje […]

Przeczytaj w: 4 min

Podatek VAT, rejestracja VAT i same rozliczenia VAT stanowią niemały problem dla sprzedawców online działających na terenie Unii Europejskiej. Różnice między wysokością stawki zależne od kraju, różnice wynikające z rodzaju […]

Przeczytaj w: 5 min

Pozycja międzynarodowego potentata internetowego handlu to jednocześnie przywilej i przekleństwo. Z jednej strony można cieszyć się ogromnymi zyskami, które firmie Amazon pozwalają wejść nawet na rynek produkcji filmowej. Wadą ogromnej […]

Przeczytaj w: 3 min

Sprzedaż swoich produktów bez reklamy jest możliwa, ale wszyscy dobrze wiedzą, że opłaca się nią posiłkować. Jeśli myślisz o tym, żeby zareklamować oferowane produkty na Amazonie, pierwsze, co musisz zrobić, […]

Przeczytaj w: 5 min

Co to jest model FBA? FBA (skrót od angielskiego Fulfillment by Amazon) to model sprzedaży, w którym cały proces logistyczny, a więc przechowywania, pakowania i wysyłki, przeniesiony jest na Amazon.

Przeczytaj w: 4 min

FBM (skrót od angielskiego Fulfillment by Merchant) to model sprzedaży na platformie Amazon, w którym sprzedawca odpowiada za cały proces sprzedażowy, w tym za magazynowanie, pakowanie, wysyłkę towarów oraz obsługę reklamacji i zwrotów.

Przeczytaj w: 5 min

Pan-European FBA jest jedną z opcji dostępnych w ramach korzystania modelu Fulfillment by Amazon. Oprócz tego, że Amazon przejmuje cały proces związany z magazynowaniem i wysyłką towarów, to dodatkowo ma […]

Przeczytaj w: 5 min

Kiedy powinienem zarejestrować się do VAT w innym kraju? Czy mam obowiązek rejestracji do VAT za granicą? Przekroczyłem limit sprzedaży wysyłkowej i co teraz? Czy mogę dobrowolnie dokonać rejestracji VAT […]

Przeczytaj w: 3 min

Amazon w Polsce uruchomi swój serwis do końca 2020 roku, jak podała “Gazeta Wyborcza”. Amazon.pl może wiele zmienić na polskim rynku e-commerce. Podobno Polska Poczta przeszła jakościowe testy i to […]

Przeczytaj w: 5 min

Od 1 października 2019 roku wszedł w życie nowy obowiązek podatkowy dla sprzedawców na platformie sprzedażowej Amazon.de i eBay.de, który zobowiązuje ich do załadowania na platformę certyfikatu podatkowego UstG 22F. […]

Przeczytaj w: 4 min

W piątek 31. stycznia 2020 o 23:00 wieczorem czasu brytyjskiego (czyli o północy w Polsce) Wielka Brytania po 47 latach przestałą być członkiem Unii Europejskiej. Od samego początku Brexit na […]

Przeczytaj w: 2 min

Amazon to platforma sprzedażowa, dzięki której możesz sprzedawać swoje produkty klientom z różnych krajów, nie tylko z Polski. Zwiększenie zasięgu sprzedaży to pierwszy i skuteczny krok do zyskania większej liczby […]

Przeczytaj w: 5 min

Amazon to platforma oferująca nie tylko pośrednictwo w sprzedaży internetowej, ale i rozmaite usługi związane z magazynowaniem, pakowaniem, wysyłką oraz zwrotem zamawianych przez klienta towarów. Koszty sprzedaży na Amazon są […]

Przeczytaj w: 6 min