Intellectual property protection is a very important topic in the e-commerce and cross-border e-commerce industry. Many sellers have encountered offers containing counterfeit versions of their original, manufactured products. Moreover, this […]

Read in: 6 minHow to sell your products all over Europe on Amazon, or Pan-European FBA

- Last update: 23.02.2024

- Published: 16.11.2020

- Read in: 5 min

A natural choice for retailers who plan to grow their business and generate increased profits on the Amazon platform is the Fulfillment by Amazon (FBA) service, which allows them to store goods in Amazon warehouses and gives them the entire process of preparing and sending a package. One of the options is PAN-European Fulfillment by Amazon.

However, before you decide on this choice, it is worth taking a close look at this FBA option, see what it entails and whether it is certainly an ideal option for you and your business.

Fulfillment by Amazon (FBA)

When registering with Amazon you can use two ways to send your products to the customer – you can send them on your own, using the so-called FBM, or Fulfillment by Merchant. When choosing this option, however, it should be remembered that you are responsible for practically everything related to the shipment – both the choice of your own packing method, taking care of proper filling of the package, correct weighing of it and the forwarders. In other words, although Amazon provides some support for beginner merchants, this choice can be quite cumbersome.

A salesperson who is serious about developing their business on Amazon should focus on developing that business and the sales itself, so it is recommended to ship in the FBA model, Fulfillment by Amazon. Using this service you send your products to different Amazon warehouses. There they are properly stored, properly packed, weighed, and then sent to customers who have decided to make a transaction. It is worth using this option because it has an additional positive impact on the ranking of your products. This is because most of the goods sent from the FBA model have the rank of Prime. The inclusion of your products in Amazon Prime’s offer results in the fact that the customer does not bear the delivery costs and the product goes to them immediately. It is logical that customers tend to choose the articles that have this rank first. This, in turn, strongly influences their confidence in the seller and increases sales and, consequently, profits!

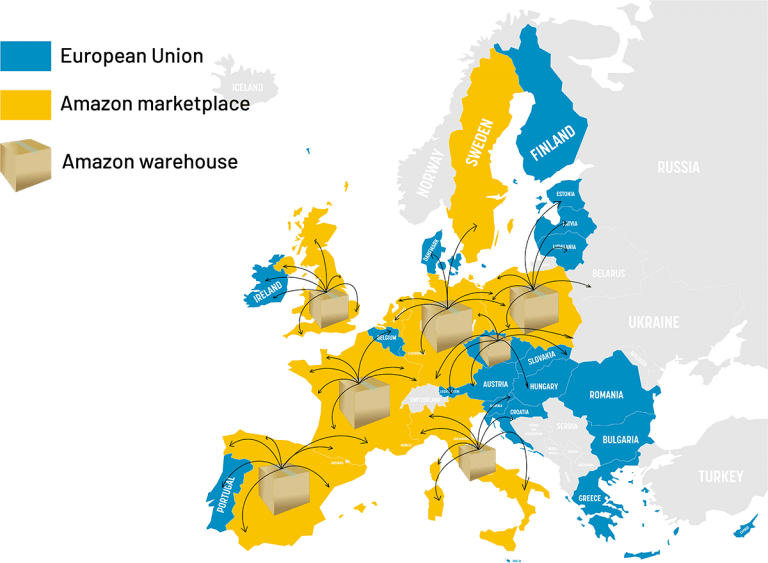

The FBA service has a variant of EFN, i.e. European Fulfillment Network, consisting in using one Amazon warehouse for sales throughout the EU and a variant of MCI, i.e. Multi-Country Inventory, in which sales on the various Amazon markets in the European Union take place after the goods are sent to specific warehouses – selling to the British market, you send to warehouses in the UK, to the German market, to warehouses in Germany, etc. Another variant of the FBA model is the Pan-European variant, which makes this choice seemingly simple for those selling their goods in the European Union. Unfortunately, like all such facilities, it brings with it a certain “but.”

What is PAN-European FBA?

The Pan-European FBA system, as the name suggests, applies to the whole of Europe. However, this has little to do with politics, and the idea in the Amazon example is really simple – as a seller, you decide to ship your goods to one particular Amazon warehouse. Once there, Amazon’s side is to send it in the right amount to other warehouses in the seven other EU countries where Amazon has its warehouses (Poland, Czech Republic, France, Spain, Germany, Great Britain, Italy), and from there on to the customer (including packing, weighing, filling, etc.).

In other words, this model is de facto easier for the FBA system vendor. You simply choose one magazine, and Amazon takes care of the rest. Sounds perfect, right? Probably that’s why it’s not 100% perfect. But let’s first focus on the undoubted benefits you get by choosing this model. It is worth noting at this point that Amazon, although it gives the opportunity to sell its products in 5 European markets, has warehouses in 7 European Union countries. This will be important when we proceed to the clue of this article.

Lower costs

A seller who intends to trade their goods in different EU countries no longer has to send their products to different warehouses. This automatically reduces the cost of shipping and all that is connected with sending your goods to different places – just to mention the time saved! Let’s not forget that time saved is money saved. You save it additionally on delivery costs (they can be even 40% cheaper!) and on managing your stock in specific markets. In the Pan-European FBA model, you need to have control over only one warehouse, to which you send your goods. Amazon will take care of the rest, free of charge.

Warehousing (and management!)

If we are already talking about storage, let’s develop this idea a little. The Fulfillment by Amazon variant undoubtedly makes life easier for salespeople, but they still have to reckon with the fact that the supervision of the stock is within the scope of their duties. You control how many pieces of goods you send to which country, what is the state of each warehouse in each of these countries and you distribute goods between these warehouses. This is where Amazon’s extensive logistics are handled. If your goods will be in one warehouse chosen within the Pan-European FBA model, Amazon will make sure that they will be delivered to those European customers who want to buy them – regardless of the country to which they have to be sent! However, stock monitoring is important. You need to know perfectly well how the sold goods move and then show it in the VAT returns in the European Union. Fortunately, this is also what the taxology application does.

Delivery, customers, support

The merchandise of the sellers who chose Pan-European FBA is close to customers as it goes to the chosen warehouse in the five European Union markets where Amazon operates. This way you reach millions of Amazon Prime users with your Prime products, which, as we mentioned, can significantly increase your sales and revenue. In addition, Amazon provides you with support, and so responds to customer inquiries, returns and refunds.

The PAN-European FBA variant sounds like Amazon’s salesman’s dream come true so far, doesn’t it? There is one hook, but before we get to it. It is also worth learning how to join this program.

- Make sure you have an Amazon dealer account in Europe that will allow you to create and manage FBA offers in the Amazon European markets.

- Make sure that the products you wish to display are eligible for pan-European sales by using the FBA’s pan-European stock management website, which will allow you to check your eligibility status and allow you to view your products for local commercial compliance.

- Create a quotation or ASINs (Amazon Standard Identification Number, a 10 character unique identifier assigned by Amazon to identify the product. Before registering a product, it must have an active FBA offer on every Amazon European market. 4) Register your products in the Pan-European FBA, Enable the Pan-European FBA variant in the Amazon Seller Central portal and register your projects in this variant.

Once you have done so, you can start sending your products to Amazon’s warehouse in your chosen country. You can also start using Amazon’s demand forecast, which will allow you to know where Amazon will distribute your goods to fully meet the expected demand in the European Union.

So what’s the catch?

With the advantages alone and the relatively easy start of sales in the Pan-European FBA variant, a “but” must appear.

In this case it is VAT. In fact, by choosing the Pan-European FBA sales model, the seller is forced to register for VAT in all seven countries where Amazon has its European warehouses. This registration should therefore take place not only in France, Spain, Germany, Italy, Great Britain and Spain, but also in Poland and the Czech Republic.

Amazon is free to move goods between its warehouses within the European Union, so VAT registration is required in all seven Pan-European countries.

Due to the reporting obligations in these countries, the seller must carefully control the volume of sales and costs incurred. The seller must also control the value of the goods being moved, which must also be shown in the VAT returns.

What are these goods movements? All you need to know about Amazon FC Processing and FC Transfer

Consequences

The obligation to register for VAT involves the risk of additional costs related to both registrations and declarations in individual countries.

In addition, there is an obligation to settle and report VAT. This involves the costs of accounting, which, like the Pan-European FBA, operates on a pan-European basis and is constantly updated with changes in national tax law. Failure to comply with the obligation to register and report VAT may result in legal and fiscal sanctions, such as, for example, obligations to pay overdue taxes with interest, criminal fines, a ban on selling products on Amazon… in other words, when choosing the Pan-European FBA you must be 100% convinced that it is the right choice for your business.

By making this choice, it is worth working with the right partners to help you get through the VAT reporting associated with the Pan-EU FBA model.

Is it worth choosing PAN-European FBA?

First of all, get acquainted with the responsibilities you will have to fulfil when deciding on this sales option. Of course, if you are interested in starting selling right away in all five Amazon markets in the European Union, then this is the model that has been created for you.

However, please be patient and use the right tools to register effectively and ensure all the VAT obligations that Amazon will impose on you. Seller who starts their adventure with Amazon is usually recommended to focus on one market and ship from one warehouse in FBA variant. It is easier to develop your business gradually than to sell to the whole European Union without having experience in the complexities of VAT and restrictions imposed by Amazon, especially since in the FBA model you can sell your goods from one country to the whole European Union (goods are then shipped from one country).

Pan-European FBA has many advantages and it seems that its only disadvantage is the obligation to register and settle VAT in seven European Union countries. For a person who wants to fully focus on developing their business, it can be extremely cumbersome, complicated and above all time-consuming.

There are, however, systems that take over tax obligations from sellers in an efficient and automated way, allowing them to focus on developing their e-commerce. One of them is taxology. With us, the choice between FBA, and Pan-European FBA is much easier.

We deal with taxes, you focus on your business. Take a look at VAT Compliance services, or contact us should you have any questions.