Intellectual property protection is a very important topic in the e-commerce and cross-border e-commerce industry. Many sellers have encountered offers containing counterfeit versions of their original, manufactured products. Moreover, this […]

Read in: 6 minLooking for how to sell on Kaufland? Find out what you need!

- Last update: 23.02.2024

- Published: 06.10.2023

- Read in: 10 min

The Kaufland platform, which is part of the Schwarz Group (the same company that owns the Lidl chain of stores), ranks among Germany’s largest and most prominent marketplaces. As stated on the official platform website, what sets Kaufland apart is its remarkable reach, with 32 million monthly visitors, and an extensive catalogue of over 45 million products spanning more than 5,000 categories. Consequently, for entrepreneurs seeking to enter the German market, they can do so through Kaufland.de.

Moreover, in 2023, Kaufland extended its services by introducing dedicated websites for customers in the Czech Republic (Kaufland.cz) and Slovakia (Kaufland.sk). This expansion opens up fresh avenues for businesses to explore these markets. For those curious about the steps necessary to initiate sales on Kaufland.de or any of its regional counterparts, we address this topic in the article!

In this article you will find out:

- Where do I register for Kaufland marketplace?

- What conditions must be met in order to sell on Kaufland?

- What documents are required to start selling on Kaufland?

- What are the fees and commissions associated with selling on Kaufland?

- What are the legal regulations?

- How do I settle the VAT on sales made on Kaufland?

Registering on the Kaufland platform

To initiate the process of selling on Kaufland, the first crucial step is to sign up on the platform.

This involves completing a registration form, which can be accessed at the provided address. Importantly, for a successful registration, entrepreneurs are required to provide specific information about their company and the products they intend to list on the platform.

Additionally, in order to start selling on Kaufland, companies must meet various conditions. These conditions can vary based on factors like the specific version of the Kaufland marketplace being utilized or the legal structure of the company.

Requirements for registering as a seller on the Kaufland platform

As we mentioned earlier, the Kaufland platform offers three versions. In addition to its original German version, there are two others – Czech and Slovak. Each of these versions operates under slightly different rules and regulations.

As a result, the prerequisites for starting to sell on Kaufland’s marketplace platform will vary, depending on the specific national regulations in each of these markets.

General registration requirements for sellers

However, it’s crucial to begin by emphasising that regardless of which sales platform in the previously mentioned countries you intend to use for selling, there are also essential general sales conditions that must be fulfilled as a top priority when creating a seller account. These conditions include:

- Operating a business (which does not necessarily need to be registered in Germany, the Czech Republic, or Slovakia).

- Maintaining sufficient telephone and email availability.

- Being capable of communicating with customers in either German, Czech, or Slovak.

- Not offering prohibited items for sale.

- Obtaining the EAN (GTIN) numbers for all the products you intend to list on the Kaufland platform.

Country-specific conditions for registering on the Kaufland marketplace

As previously mentioned, Kaufland’s service necessitates that new sellers meet specific requirements to open an account. These requirements vary based on whether they intend to sell on the Kaufland.de, Kaufland.cz, or Kaufland.sk platform.

- Ensuring that it is possible to ship to end customers and process returns from the target country from Germany, the Czech Republic or Slovakia.

- Providing customer communication in German, Czech or Slovak at least in written form.

- Provided product details in German, Czech or Slovak.

- Provided legal texts in the local language.

In addition, sellers from European Union member states must provide their national VAT numbers and proof of VAT OSS registration or must obtain VAT numbers in Germany, the Czech Republic or Slovakia (depending on the version of the platform they use).

Third-country sellers, on the other hand, must mandatorily provide a VAT number depending on the country associated with the version of the platform, and must also designate a person responsible in the European Union for CE-certified products manufactured outside the member states.

Requirements depending on the legal form of the company

Another factor influencing the requirements for establishing a merchant account is the legal structure of the business.

For sole traders, it’s necessary to submit an entry from the Register of Businesses (CEIDG).

In contrast, limited liability companies, general partnerships, or limited partnerships are required to provide the aforementioned excerpt from the court register (KRS), along with evidence of the shareholding structure.

For civil law partnerships, on the other hand, the documentation needed includes an excerpt from the CEIDG, a document verifying the share structure (typically a partnership agreement), and copies of personal identity cards of the representatives.

Documents required to open an account on Kaufland

In addition to meeting the aforementioned requirements, in order to create an account and start selling on Kaufland.de, Kaufland.sk or Kaufland.cz, a number of necessary documents must be provided, which are:

- a current statement of the company’s bank account, bearing the bank’s logo, the IBAN and SWIFT numbers of the account, as well as the bank’s contact details and the account holder’s details,

- confirmation of registration with the dual system LUCID,

- capital share in %, in English or German,

- identity card or passport of all company representatives,

- details of the company’s beneficial owners.

Need help with VAT or e-commerce accounting?

Indicate what the problem is and our VAT Compliance specialists will take care of it for you. Regardless of whether it is about registration, declarations or settlements of VAT, VAT OSS or VAT EU.

Schedule a consultationBeneficial owner

Kaufland requires its users to provide the relevant information regarding the beneficial owners, which, as you can read on the website of the service, are “a natural person who is the owner of funds or other assets of your company, or a legal entity (such as a limited liability company) that ultimately has control over the company. The beneficial owner directly or indirectly holds 25 % or more of the shares or voting rights in your company. Therefore, several persons of your company can be beneficial owners.”

Accordingly, beneficial owners are required to provide data such as:

- name and surname,

- place and date of birth,

- home address,

- information on the exact capital share (in %).

In addition to the above, the memorandum of association as well as the list of shareholders must be provided.

Account verification

Upon the submission of the registration form and the necessary documentation to Kaufland’s service, further verification steps are still necessary.

For sole traders or individuals, this verification involves a video interview to assess the entrepreneur’s proficiency in English or German. If it’s determined that they cannot effectively communicate in these languages, a Kaufland representative may not approve such a seller.

Conversely, once the video verification process has been successfully completed, and the seller’s account has been activated, the seller must still choose the subscription type and prepare the required legal documents.

Kaufland service and fees

If you want to sell on Kaufland.de or either of the other two versions of this marketplace platform, there are costs involved.

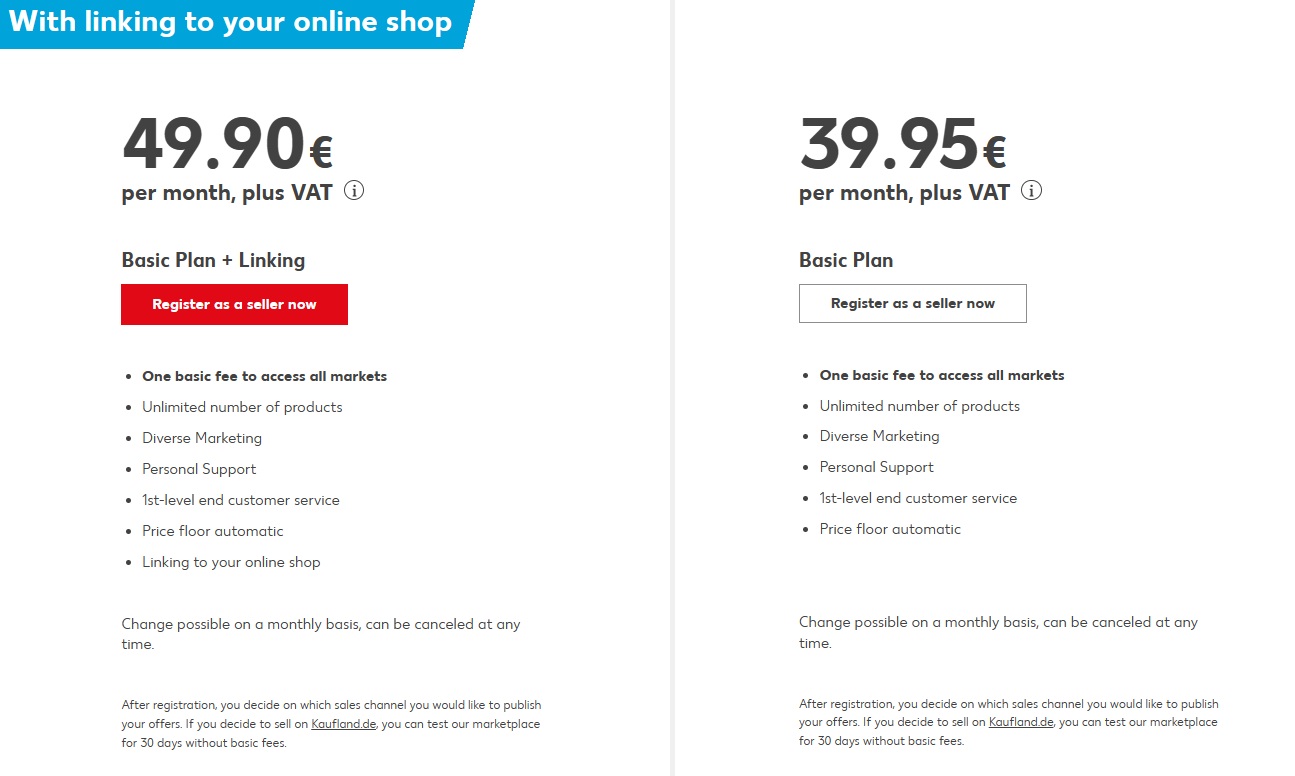

These amount to EUR 39.95 + VAT or EUR 49.90 + VAT per month and include:

- possibility of displaying an unlimited number of products,

- multi-channel marketing tools,

- personal support,

- 1st-level customer service from Kaufland,

- option to automatically set the price floor.

However, the key difference between the more costly package and the cheaper option is the ability to insert a link to your online store on your Kaufland company profile.

Commissions at Kaufland

In addition to the previously mentioned subscription, selling products on the Kaufland platform also involves commissions. The commission amount varies depending on the product category. For instance, in certain categories like computers, electrical appliances, tires, rims, and wheel sets, the commission is set at 7% of the sale price, which includes shipping and VAT.

On the other hand, perfumes have a commission rate of 10%, while categories like toys, furniture, or home furnishings carry a 13% commission.

For the exact commission rates in other categories, you can refer to Kaufland’s website, where you will find detailed information.

Legal texts

Another crucial aspect of getting ready to sell on the Kaufland platform is the legal documentation outlined in the national platform registration conditions, including:

- the company’s footnote,

- return policy,

- privacy policy,

- terms and conditions of sale.

It’s important to note that each of the aforementioned documents comes with specific requirements regarding the information they must contain. For example, the sales terms and conditions document should specify details such as the accepted payment methods for potential customers, as well as the procedures for addressing complaints and warranty issues.

The return policy should include information about various factors, including the time frame within which customers can return a purchase without providing a specific reason and who is responsible for covering the return expenses.

Once these particular matters are settled, you can proceed with selling on Kaufland.de, Kaufland.cz, or Kaufland.sk.

Kaufland sales vs. VAT

When seeking to become a seller on the Kaufland.de, Kaufland.sk, or Kaufland.cz platforms, it’s crucial to consider VAT matters. These VAT concerns pertain to two key areas: sales to customers from a different country and the warehousing of goods outside the seller’s country of residence.

Sales to international customers

In the context of the German, Czech, and Slovak versions of the Kaufland platform, we are speaking about countries that are part of the EU. Therefore, it’s essential to take into account the threshold for intra-Community distance sales of goods, which is set at EUR 10,000. This threshold pertains to the total value of sales made by a single company to individual customers from other EU countries.

As a result, once a transaction exceeds the aforementioned limit, business owners are required to settle VAT for sales in the country where the goods are delivered, which typically necessitates prior VAT registration. Alternatively, they can opt for a specialised VAT OSS procedure, which streamlines the handling of all B2C sales between EU member states in a consolidated declaration.

It’s important to note that one of the conditions for registration with Kaufland, as we mentioned previously, is providing a national VAT number, such as VAT DE, VAT CZ, or VAT SK, or being registered in the VAT OSS system.

Warehousing goods abroad

However, when it comes to the storage of goods in another country, the scenario is somewhat distinct. If traders choose to do this, perhaps as part of an e-commerce fulfilment service, they are required to register for VAT in the respective local jurisdiction. This entails reporting the movements of their goods, B2C sales within that country, B2B sales originating from that country, and exports of goods in a manner compliant with local regulations. It’s important to note that in these situations, the use of VAT OSS, which is designed exclusively for handling B2C sales between EU countries, is not applicable.

It’s also important to consider that VAT-related matters may vary based on the country or the specific type of goods being sold. Therefore, seeking guidance from a specialist is recommended. If you require assistance, don’t hesitate and schedule a free consultation to see how our VAT Compliance team can provide valuable support for your business.

How do you sell on Kaufland.de? - summary

Kaufland undeniably stands out as one of Germany’s rapidly growing marketplace platforms, providing retailers with access to a diverse customer base. Moreover, in 2023, the service expanded its reach by introducing versions of its platform tailored to the Czech and Slovakian markets, enhancing the potential to connect with new audiences.

Nonetheless, it’s crucial to acknowledge that, much like other marketplace platforms, Kaufland also imposes specific requirements and conditions that must be met before commencing sales through the platform. These prerequisites include tasks such as creating an account, providing the necessary information and documents, and successfully passing a verification process.

Additionally, please be aware of the VAT-related issues such as registration, settlement and filing local VAT returns, or the potential utilisation of the VAT OSS procedure. If you require assistance with any of the issues addressed here or require accounting services specifically tailored to your e-commerce business, you can schedule a free consultation, and our VAT Compliance team will be delighted to offer their support.