Intellectual property protection is a very important topic in the e-commerce and cross-border e-commerce industry. Many sellers have encountered offers containing counterfeit versions of their original, manufactured products. Moreover, this […]

Read in: 6 minHow to sell on Amazon?

- Last update: 23.02.2024

- Published: 28.08.2020

- Read in: 5 min

How to sell on Amazon? How to register, what account to choose, how to add products, what is listing, how to send products to customers to meet Amazon requirements?

These are just some of the questions a reseller should consider if they want to start operating on Amazon.

4,000 products per minute. 240,000 products per hour. 5,760,000 products per day. These numbers reflect the average Amazon sales. No wonder that increasingly more salespeople decide to develop their e-commerce on this platform, which is storming new markets. And it is worth mentioning that nowadays, before searching for products on Google, Internet users tend to look for them on Amazon; it is there that they start their search. That is why it is pivotal to think about joining the largest sales platform in the world right now.

In such a situation, it seems logical that an Amazon product dealer will be faced with competition. And what a competition! Currently, there are 2.5 million salespersons working on the platform! Since the beginning of its operation, almost 25 thousand of them have already earned over one million dollars, and 200 thousand sellers have increased their assets by 100 thousand dollars. Every year hundreds of thousands of new sellers join Amazon. This, however, brings with it certain restrictions that must be met if you want to list your products.

But let’s start from the beginning. How to start selling products on Amazon?

To start selling, we need to go through some basic steps. We will try to describe this process as accurately as possible – from registration, through account selection, method of delivering the package to the customer, to listings and sending orders and automatic invoicing. We will also describe in a nutshell what not to do to avoid blocking your Amazon account and briefly present the tools we have chosen to make life easier for Amazon product sellers.

To start selling, we need to go through some basic steps. We will try to describe this process as accurately as possible – from registration, through account selection, method of delivering the package to the customer, to listings and sending orders and automatic invoicing. We will also describe in a nutshell what not to do to avoid blocking your Amazon account and briefly present the tools we have chosen to make life easier for Amazon product sellers.

How to register an account on Amazon?

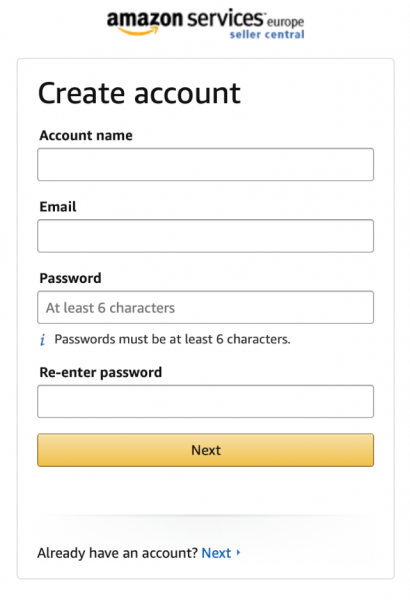

As in any other service of this type, the sales process begins with the registration of the seller’s account. To successfully pass this process, Amazon will require a lot of details, and you will need to choose the account name you will use on Amazon and enter an e-mail address, to which you will receive a one-time confirmation code. Additionally, you need to choose the form of our company (e.g. one-person business, limited liability company, natural person), provide the details of the company, contact person, bank account information, or link a credit card. Amazon has prepared a neat tutorial and describes step by step what data should be provided in a specific step.

As in any other service of this type, the sales process begins with the registration of the seller’s account. To successfully pass this process, Amazon will require a lot of details, and you will need to choose the account name you will use on Amazon and enter an e-mail address, to which you will receive a one-time confirmation code. Additionally, you need to choose the form of our company (e.g. one-person business, limited liability company, natural person), provide the details of the company, contact person, bank account information, or link a credit card. Amazon has prepared a neat tutorial and describes step by step what data should be provided in a specific step.

First of all, you need to think about which markets you want to operate in, and how many goods we can sell. It is advisable to become familiar with the model of cooperation with Amazon you are mostly interested in – FBA and FBM.

In Fulfillment by Amazon (FBA), you have options such as EFN (European Fulfilment Network), which consists of selecting only one Amazon warehouse and selling all over Europe. Amazon Pan-European, on the other hand, relies on sending its goods to one Amazon warehouse in Europe, from where Amazon sends them to other warehouses. Amazon will automatically launch the latter service. It will make it easier for you to increase your online sales through access to first-class logistics solutions, fast and free delivery and local language customer service. It is very different from the Fulfillment by Merchant (FBM) service, which will be announced shortly.

When registering, you must also provide your details, such as your name, address, ID card number; all this for the purpose of customer verification, which will protect all parties from potential fraud. This process may seem tedious, but when selling online, you should have in mind the “better safe than sorry” principle. You complete your account registration by providing the documents required by Amazon, which must be enclosed as attachments. After attaching the documents, you wait for positive verification of the account. But this is not the end.

Amazon sales rules: FBA or FBM – what to choose?

When signing up with Amazon, you can use two ways to send products to the customer; you can send them on your own using the so-called FBM, or Fulfillment by Merchant. In this sales option, Amazon is only a platform for selling your product. When choosing this option, however, keep in mind that you are responsible for practically everything related to the shipment – both the choice of your own packing method, taking care of the proper filling of the package, correct weighing of it, and the forwarders. The seller is also responsible for returns and complaints. In other words, although Amazon provides some support for novice retailers, this choice may quickly become quite burdensome as it involves additional work on the seller’s side.

The main question is, is it worth burdening yourself with additional duties but obtaining in return full control over your products? After all, Amazon is famous for the highest quality of delivery and storage, so why not entrust the whole process to this professional logistics company?

A salesperson who is serious about developing their business on Amazon should focus on the development of that business and the sales, so the FBA, Fulfillment by Amazon shipment model is recommended. With this service, you send your products to different Amazon warehouses. There they are properly stored, packed, weighed and then sent to customers who have decided to make a transaction. Use this option as it has an additional positive impact on the ranking of your products. This is because most of the goods sent by the FBA model are Prime goods. The inclusion of your products in Amazon Prime’s offer disables delivery costs on the customer’s part and the product reaches them immediately. It is logical that customers tend to choose Prime articles first. This, in turn, strongly influences their confidence in the seller and increases sales and, consequently, profits!

Sales options in FBA model – Amazon Pan-European (Pan-EU), Amazon Multi-Country Inventory (MCI) and Amazon European Fulfilment Network (EFN).

FBA: Amazon EFN, Amazon MCI, and Amazon Pan-EU – what are these? What to choose?

The FBA service has two variants – Amazon Pan-European (Pan-EU) and Amazon European Fulfilment Network (EFN). The Amazon EFN model consists of using only one Amazon warehouse in one country for sale throughout Europe. Amazon MCI is specific for fact that you also sell all over Europe, but you send your goods to specific Amazon warehouses in selected countries; if you want to sell on amazon.co.uk, you send them to a warehouse in the UK; if you want to sell through the Spanish version of Amazon, you send to a warehouse in Spain, etc.

The Amazon Pan-EU variant is the most tempting to start selling on Jeff Bezos’s website. In the FBA variant, you send your goods to one specific Amazon warehouse. Once there, Amazon will take care of sending it in the right number to the next warehouses in the other six European Union countries where Amazon has its warehouses in such a way that your goods are located as close as possible to the potential customer. From there, they will be sent further to the customer (including packing, weighing, filling, etc.). In other words, this model is actually an easier FBA system for the seller. You simply choose one warehouse and Amazon takes care of the rest.

Each of these three FBA models, however, brings with it a certain additional inconvenience, the obligation to register a VAT number in the country where your goods will be stored. If you do not use Pan-EU, you will pay a much higher shipping fee by selling your goods to customers from different countries. The Pan-EU model pays off for those sellers who know that they will operate in all Amazon markets in the European Union and send their goods to their warehouses. It certainly pays off to those sellers who generate at least 1,200 transactions per month. So think carefully about it if there is a risk of smaller sales.

Registration for foreign VAT numbers differs from one another in these three models. Before choosing one of them, it may be crucial to choose a company that deals comprehensively with registration and VAT settlements for those selling their products on Amazon. Please read our offer and if you have any questions about VAT registration – contact us!

The FBA shipping model has another advantage – the automation of VAT invoices. Thanks to this service, you don’t have to issue invoices after each completed order; Amazon will send them to the customer. Getting started is simple – simply enter your company’s VAT numbers and enter your company’s default address. In the settings, you choose the activation date and VAT code for your offers. You can access all VAT invoices and VAT reports at any time. All VAT invoices are issued in accordance with the European Union VAT Directive. They also comply with the national regulations applicable to each EU country. Automation reduces the contact between buyer and seller, so again, you save time that you can spend on developing your business and increasing your income. Thanks to this option you also increase your chances for sale among businesses that also want to save time connected with each contact on invoices. Launching this service, where Amazon does not issue invoices on its own, is a classic win-win situation.

However, in order for the invoices to be issued correctly, it is necessary to take care of the correct configuration of the account on Amazon, as well as to meet a number of official formalities. If you are not sure – contact us and you will advise you on this!

Automatic invoicing to Amazon

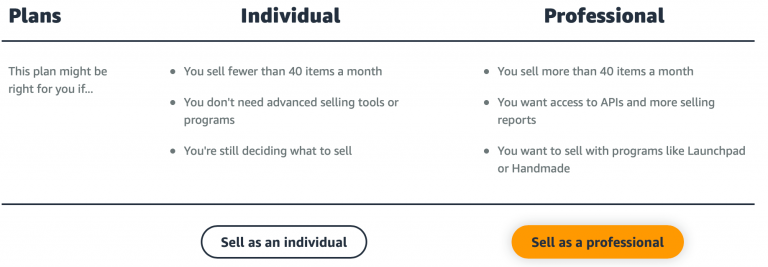

On Amazon, you have two types of accounts to choose from. The first one is the Individual Account, which is free and allows you to sell 40 products per month. When choosing the basic account, you pay Amazon € 0.99 or £ 0.75 for each product sold.

The second account is the Professional Account, which allows you to sell an unlimited number of products. By choosing this account, you do not pay a fixed fee for the sale of each item, but you pay € 39 or £ 25 per month to use it. This is an obvious choice for users who do not want to sell their products online additionally and consider it more a form of attractive self-employment.

Initially, it is a good idea to choose an individual account, get to know more about Amazon’s mechanisms, and then go to the Professional account, which is chosen by most vendors. However, please note that regardless of the account type you choose, Amazon will charge a commission on the item sold. The amount of the commission depends on the items sold and varies between 7% for electronic devices, up to 20% for jewellery for a part of the total sales price up to € 250. Amazon’s commission and fee issues are a river theme and are suitable for a separate article.

To list your products for sale on Amazon, you add the product to an existing list or create your own list. Listing here is the page of your product, on the basis of which customers choose their goods. This is unquestionably one of the key elements of any online sale, as both the content of this page and its overall appearance will translate into successful sales. The listing on Amazon consists of the listing title, the key features of the product, its photo and description, and additional information.

Most retailers choose to add their goods to an existing listing. To do this, you should first check if other sellers offer your product. In order to attract customers’ attention, you can lower the price of your sale, offer free shipping, or use the FBA program mentioned above.

It is important that you choose the most beneficial listing for you. The highest position in the ranking, good description, positive opinions and photos are the criteria you should follow. Creating your own listing is much more time consuming, but it allows you to create your own auction and add your own product photos, descriptions, and keywords.

What is Listing on Amazon?

You have two ways to choose between sending your products to the customer. The first one is Fulfillment by Merchant (FBM), i.e. shipping on your own. Although Amazon makes it easier for novice salespersons, there is nothing to hide – choosing your own packaging, taking care of the proper filling of the package, weighing it, and forwarding agents is quite burdensome. It is much better to focus on sales development, and leave the shipping option in Amazon’s hands. By choosing Fulfillment by Amazon (FBA), you send your products to Amazon’s warehouses, where they are stored, properly packed and sent to customers. Using this service has an additional positive impact on the ranking of your products, most of the products sent through FBA are Prime (and most buyers are looking for Prime products!). This translates directly into confidence in the seller and increased sales.

How to send orders on Amazon?

The customer is most important.

Amazon does not treat this slogan lightly and ruthlessly accounts for those sellers who do not share this opinion in Amazon’s eyes. The most common penalty is account blockage, which is associated with the loss of sales opportunities on Amazon, and thus loss of income.

So what situations should be avoided if you don’t want to lose access to your sales account?

First of all, it is the product quality. Any counterfeits and products of poor quality may attract the attention of Amazon’s control, lead to the withdrawal of these products from sale and finally to the blocking of the account. Another reason may be the sale of forbidden products, and here you probably don’t have to explain anything more – since Amazon forbids selling particular goods, selling them you know what you are signing up for. It is also worth checking whether the products you are selling do not fall into the category of gambling, which requires additional sales permits from the seller due to the potential risks associated with the product. Often the seller is required to show the necessary certificate that allows for the sale.

The use of someone else’s logo or trademark, and thus the infringement of intellectual property, is also not positively perceived by Amazon and can lead to the account being blocked. And so far everything seems simple and logical – permits, certificates, prohibition of sale of forbidden goods. But that is not all.

Manipulating reviews, linking to external websites, setting up several accounts or not writing on clients’ messages – all this can put you in the wrong light and ultimately lead to account blocking. What if an account is blocked? The easiest way is to write to Amazon support. There are already companies on the market that deal with it comprehensively, going through the whole process and issuing a list of mistakes made. They discuss the problem with the seller to make sure that he will not inadvertently let it happen again.

Amazon account lock

There are many tools that support salespersons in their work on Amazon. Those tools analyze sales, help to search for specific products, check the competition. One of the leading tools is Sellics, a keyword search engine that will help you promote your business in terms of SEO. Another useful device is the SellerBoard, a tool that helps with PPC optimization. Helium10 and Jungle Scout significantly improve the product search, while taxology facilitates the registration and settlement of VAT taxes, thoroughly analyzes the profitability of products and allows for the dynamic development of e-commerce business.

VAT issues are mentioned in the first place as problems encountered by their dear sellers. The process of creating an account and selling at Amazon is in fact extremely simple. What hinders the whole seller-customer journey and is a frequent source of problems for sellers offering their services on Amazon is the difference in taxation of products shipped to other countries. After all, by choosing Amazon you want to send your products abroad as well, and not just close yourself off for local sales. The important thing is to choose the right tool that not only clears the VAT quickly and reliably, but also enables you to monitor your sales, analyze your profitability, and develop your e-commerce comprehensively.

taxology will take care of these things and you will focus on earning your business, contact us >>.